This content is made possible through subscriber support. Not a subscriber yet? Click here to see our subscription options or click the button below to subscribe to the full Silver Stock Investor letter.

If you’ve been reading my research even for a short while, you know that I believe solar panels will be a significant driver of silver demand going forward.

In fact, I think solar will be so important to the silver market, it will be second only to investment demand. As I’ve said many times, I believe industrial demand for silver will keep a rising floor under its price, while investment demand will cause price rallies and even spikes from that rising base. I think the investment demand will lead the charge to much higher silver prices levels in the coming years.

With solar being so key to the silver market, I’ve taken time to research exactly why that is and how silver works in solar technology. But before that, here’s something else you should know.

Silver is the most electricity-conducting metal in existence. None other is more conductive. In fact, silver sets the conductivity scale at 100 for most productive. Anything else is less efficient, and is measured against silver. What’s more, silver is considered quite fire safe, as it does not spark easily. It’s also lightweight and relatively inexpensive. All of this makes silver an ideal component in solar panels.

How exactly does silver work in photovoltaic (PV) solar panels?

In a basic sense, a paste is created with silver powder, then it’s applied on a silicon wafer. Once light hits the silicon, that solar radiation sets electrons free. Now here’s where the silver comes in. Being the world’s best conductor, the silver transmits electricity from the excited electrons to either be used immediately by the consumer, or to be stored in a battery and used later.

Just two years ago many thought silver thrifting, which is the minimizing of silver content in each solar panel, would continue to drift downwards as panel manufacturers continuously try to cut costs and improve profits. In 2020, CRU group even said they expected a gradual decline in silver demand from 2020 to 2023 as annual solar capacity slows and thrifting continues. That turned out to be clearly wrong. Instead, PV silver demand has gone from 100Moz in 2020 to 140Moz last year, a 40% increase! The Silver Institute estimates this year’s demand will be

160Moz. I’ve said I think that will end up being closer to 180Moz., or perhaps even higher.

As for substitute materials, copper has been looked at quite intensely, given its similar properties and that it’s much cheaper. Although it has comparable energy-producing capabilities, copper is difficult to work in screen printing, making it nearly impossible to use in a conventional solar panel. So, its potential as a substitute appears limited.

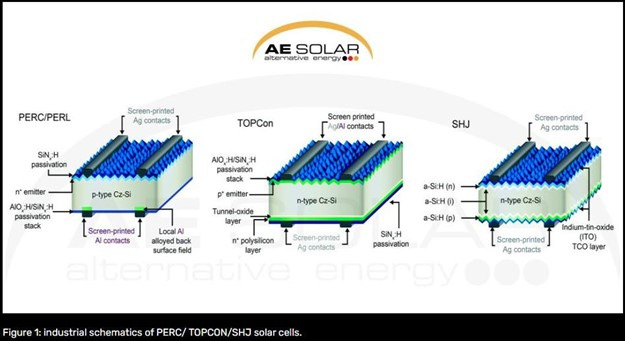

Now, I’m not going to get into the nitty gritty of the technical make up and functioning of a solar cell. Instead, it’s more important to know the three currently most common cell technologies are PERC (Passivated Emitter Rear Cell), TOPCon (Tunnel Oxide Passivated Contact), and HJT (Heterojunction), also referred to sometimes as SHJ or HIT.

HJT is currently on the cutting edge because it combines two technologies into one cell. With HJT you have a crystalline silicon cell between two layers of “thin-film” silicon. That ups the efficiency of the solar panel. Plus, the cost of manufacturing this kind of solar cell is less costly than for crystalline silicon.

This detailed graphic from AE Solar, an award-winning German solar systems installation and research company established 20 years ago, shows the construction of all three types of solar panel technologies, PERC, TOPCon, and HJT (SHJ).

Source: company reports

HJT currently in use generates efficiencies from 19.9% to 21.8%, whereas older technologies only reach 15% to 20%. The main advantages of HJT, according to AE Solar are:

They provide higher efficiency when compared to standard crystalline solar cells. There are already HJT cells that have achieved efficiencies above 25% at the laboratory level.

They have low-temperature coefficients i.e., can perform better at higher operating temperatures. Obtaining a low-temperature coefficient is indeed a crucial factor for the success of a given type of module. Temperature coefficients close to -0.3 % mean that HJT cells suffer less performance loss over their cycles.

They are already bifacial since both the top and the bottom consist of amorphous solar cells.

AE Solar says it’s forecast by the end of this decade that small-sized HJT cells will achieve as much as 28% efficiency, which is very close to the theoretical solar cell efficiency of 30% for crystalline solar cells.

AE Solar also suggests that market growth for HJT will be much faster than for traditional cell types. And being that they are already bifacial, they can be installed in megawatt-size solar parks.

Bifaciality is the ability of a solar cell to receive light from the front and rear surfaces. This feature can significantly improve energy yields. And when we consider the energy required to produce HJT cells, these consume notably less than both PERC and TOPCon.

According to the International Technology Roadmap for Photovoltaic (ITRPV) published in Frankfurt, Germany in 2022, HJT cells are expected to become the second-most adopted commercial technology after PERC/TOPCon, to reach almost 20% by 2032.

How does all this impact the silver market?

The following graphic shows the historical and predicted annual silver demand for the PV industry out to 2050.

Source: company reports

The horizontal blue broken line shows the level of silver supply in 2020. As the chart suggests, depending on technology adoption rates and solar installation growth, the silver industry could require the equivalent of all the 2020 silver supply as early as about 2038. That’s just 15 years away.

Solar panels have an expected lifespan of about 25-30 years. But technological advances can make replacing them more economical well before that, sometimes within just 10-15 years.

Current recycling can recover the aluminum and glass, but their re-use is limited.

Now in Grenoble, France, a new specialized solar recycling company, ROSI, is set to open. Their dedicated factory promises to recycle, extract and re-use fully 99% of solar panel components. This could be a game-changer, as many of these materials could find their way into new, more powerful solar units.

So, this may slow the demand for silver in solar panels through recycling. But I think the growth of solar installations will continue at such a rapid pace, it will still put tremendous pressure on the silver supply.

As this chart shows, solar investment is set to outpace oil production for the first time ever this year. Only a decade ago, solar spending was just one-sixth that of oil.

As global government policy continues to spearhead the green transition, I expect solar power output to continue at a rapid pace as the world aims for its net-zero emissions targets.

According to the International Energy Agency (IEA), installed solar capacity is set to overtake natural gas by 2026 and coal by 2027, becoming the largest energy source in the world.

If you consider that utility-scale solar is the least expensive option for new electricity generation in many countries, the growth of PV installations is not that surprising.

As a result, I see ongoing support for silver prices as solar continues its dramatic ascent toward the dominant source of energy worldwide.

To see our subscription options, please click here. To subscribe to the Silver Stock Investor now, please click the button below.