The Silver Institute, World Silver Survey 2023

From the Silver Stock Investor Newsletter | May 2023

This content is made possible through subscriber support. Not a subscriber yet? Click here to see our subscription options or click the button below to subscribe to the full Silver Stock Investor letter.

As is the case each year, The Silver Institute releases its World Silver Survey in April. Metals Focus conducts the research and writes the report for The Silver Institute. With the 2023 survey freshly published, I think it’s worth reviewing to give us a sense of how silver trends evolved in 2022, and what the outlook might be for this year and beyond.

Perhaps the most significant developments are that total global demand set a record high of 1.242 billion silver ounces, while supply was flat, leading to the highest recorded deficit of 237.7 million ounces. In its press release of last November, the Silver Institute had forecast the 2022 deficit would reach 194 million ounces, which was off by a significant 43.7 million.

This matters to us because we see ongoing growth from all the major demand categories leading to record demand. Let’s start by breaking down demand, then we’ll deal with supply.

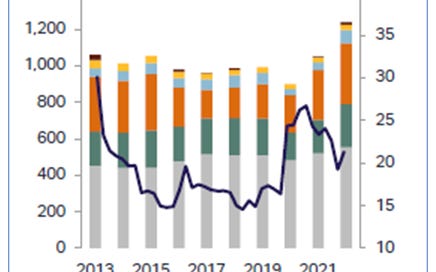

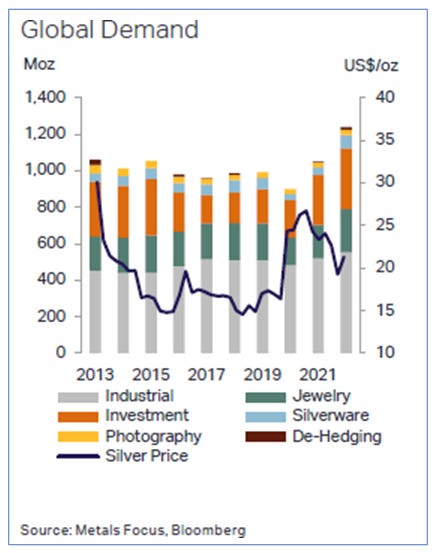

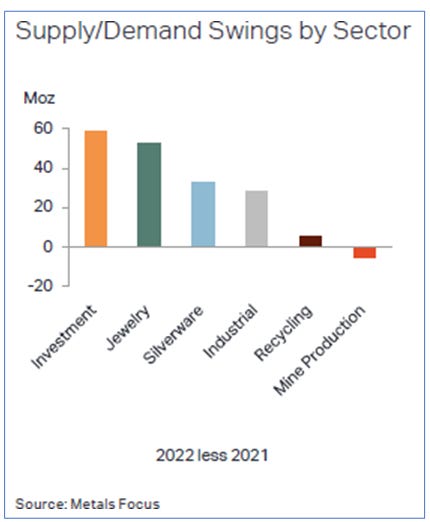

After robust demand growth in 2021 at 1.055 billion ounces, 2022 did not disappoint with demand at 1.242 billion, for a blistering 18% increase. Industrial demand was up overall by 5%, with electrical and electronics ahead 6%, including photovoltaics (solar panels) up an incredible 28%, requiring 140.3 million ounces in 2022 over 2021’s 110 million ounces. In the 2022 Survey, they had forecast that photovoltaics would require 127 Moz, which was significantly short of the actual 140 Moz demand. Now they are forecasting 161 Moz demand for 2023, a 12.6% increase. I think this will fall well short once again, and is likely to reach closer to 180 Moz.

Meanwhile Heraeus Precious Metals, a precious metals refiner, trader and recycler, thinks solar panel production and installations will reach a record level this year, in part thanks to China’s COVID-19 reopening move.

Jewelry and silverware demand exploded. Jewelry fabrication rose 29%, which was mainly an India story. Re-stocking volumes doubled over 2021. Meanwhile silverware demand soared an amazing 80%, a record high since at least 2010, dominated also by India as the country’s employment and income levels regained pre-COVID levels.

Net investment was very robust, rising for a consecutive 5th year to a new record high of 332.9 million ounces, up a very strong 22%. Here too India dominated, buying 188% more than in 2021 as they took advantage of softer silver prices.

At 332.9 million ounces, net investment represents 27% of total demand. And thanks to the large supply deficit, net investment represents an incredible 33% of supply.

Now let’s look at supply itself, and some of the challenges that came along with it.

Global mine supply was down 1% to 822.4 million ounces. This is interesting, because last November, the Institute actually expected mined silver to rise by 1%. Their forecast was also that recycling supply would rise 5% to 185 million ounces, and instead it only rose 3% to 180.6 million ounces. So, with mine supply down and recycling up less than expected, overall supply was flat. And remember, this was in a year when overall demand soared 18% to a record high.

Mined supply was down as silver by-product from lead/zinc mines fell, especially in China and Peru. Supply from primary silver mines was nearly flat, up just 0.1% to 228.2 million ounces. The worst decline was in Peru, where output dropped -8.5Moz as mines were suspended, grades fell at several major operations, and social unrest disrupted production. Higher output offset these drops, with Mexican production up by 3.1 Moz, Argentinian output up 3 Moz and Russian output up 2.2 Moz.

Recycling was up for the third straight year to 180.6 Moz, mostly thanks to industrial scrap increases, as jewelry and silverware rose only slightly. I believe that’s due to soft silver prices. When silver prices rise considerably, people are more willing to part with their old silver and sell it for cash.

The Survey thinks 2023 will see more strong silver demand, with industrial offtake reaching another record high, driven by solar in particular. They also expect bar and coin demand, as well as jewelry, will be less than in 2022 but to remain robust. As for supply, the Survey expects to see low single-digit gains, along with a still large deficit of 142.1 Moz, set to be the second largest in over 20 years. My take is this will probably prove conservative once again.

The Survey thinks cumulative deficits of 2021, 2022, and 2023 should cause global silver inventories to drop by 430.9 Moz from their 2020 peak. That’s over half of this year’s mined silver, and more than half of the silver held in custodian London vaults.

Here is my take on the Survey’s outlook. First I think this year’s deficit is likely going to be closer to 200 Moz, which is higher than the 142.1 Moz they forecast. I say that because I expect industrial demand, led by solar, electronics and electrical (think EVs and 5G) to rise steadily, and investment demand to remain strong, while mine output will remain challenged and likely close to flat once again. There are trillions of dollars that will be spent over the next decade on advancing the green transition on a global basis. The US, Europe, India, China and beyond have all committed huge sums to sustainable infrastructure. That’s going to mean strong demand for solar panels, buildout of the 5G telecom network, EVs, and EV charging stations, all of which require plenty of silver.

Since I think the Fed will pause on rate hikes in the next few months, and that inflation will remain elevated, along with ongoing risks of financial crises like bank failures, etc., we have the right environment for robust investment demand. I also think we’ll see silver prices approach the $28 level in the second half of this year. If so, that will have investors clamouring to buy silver as the FOMO (Fear Of Missing Out) trade kicks in once again. Here too I disagree with the Survey’s conclusions. They think the Fed will not cut rates later this year and that institutional demand will weaken. They also see the risks of ongoing bank and/or other financial/economic crises as having lessened in the wake of US and Swiss bank rescues. If that’s turns out to be the case, I think it’s only temporary. This problem will resurface in some form.

For these reasons, the Survey’s authors actually think silver will fall below $18 by year’s end, and that its price will average $21.30 this year, down by 2% over 2022.

While I acknowledge there is always some risk of a bearish outcome, I think the odds of that are very low, and that overall sentiment and fundamentals will drive silver higher this year. The Survey itself acknowledges that significant supply deficits will persist for at least the next five years. For these reasons, I see silver reaching $28 between now and year’s end.

To see our subscription options, please click here. To subscribe to the Silver Stock Investor now, please click the button below.