Silver Outperforms as Bonds Struggle

From The Silver Stock Investor Letter, April 2022

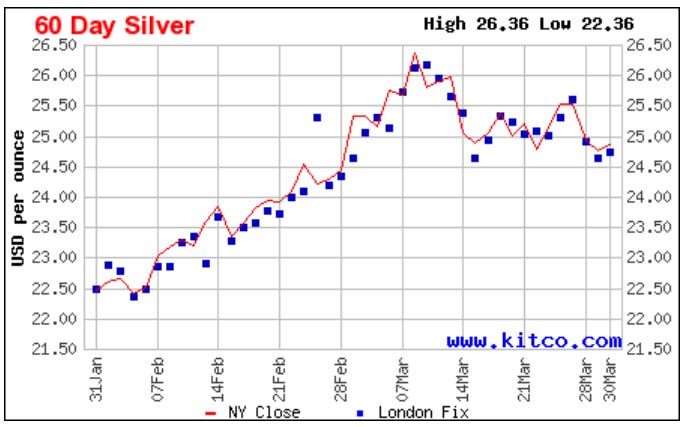

Silver has started behaving well since the start of the year. In the first three months, silver is already up 8.7%. The following chart of the last two months shows that silver began climbing in late January, then peaked in early March.

Top safe-haven assets tend to be silver, gold, the U.S. dollar, and U.S. Treasuries. Secondary ones may also be highly liquid and widely used currencies like the euro, the Swiss Franc, and the Japanese Yen.

What I find interesting is that silver started to climb a full three weeks before Russia invaded Ukraine. It’s as though precious metals were already sensing the impending military crisis, with Russian troops gathering en masse along the Ukrainian border. Silver then reversed, but not much.

In mid-March, the Fed did hike rates as widely anticipated, by just 0.25%. Silver then got another boost and has held up well since.

Now the growing consensus is that the Fed will make multiple 50-basis point rate hikes, potentially raising rates to as high as 2.75% by late this year.

I don’t buy it.

As I said in the mid-month issue a few weeks back, there’s a strong chance the Fed will be tightening (raising rates) into economic weakness, causing a recession. I’m anxiously awaiting the next inflation readings. That’s because the war in Ukraine has disrupted supply chains and basic commodity flows so severely that prices have soared. The February reading was 7.9% for the U.S. (a 40-year high), and the March reading, due out in mid-April, will account for these recent price spikes.

It would not surprise me to see inflation reading above 9%, and perhaps even close to 10% for March. That’s The Fed’s Dilemma that I discussed recently. Numbers like that generate huge pressure for the Fed to raise rates. Yet those higher rates are likely to weigh on an economy that’s trying to emerge from the pandemic. And by the way, the pandemic appears to be ramping up again. The newest BA.2 substrain of Omicron apparently spreads more easily and is more difficult to detect. Many places are entering the sixth wave. This will certainly not help boost economic activity.

While there’s plenty of debate, there are several measures for yield-curve inversions that suggest a recession lies ahead. I’m not going to get into all of that. Instead, let’s just have a look at what’s been happening with yields.

That’s a huge climb for 2-year Treasuries, from 0.5% to 2.3% in just 6 months. Meanwhile, the 10-year Treasury is now only slightly higher than the 2-year at 2.33%, having started to rise earlier.

With the market demanding nearly the same yield from 2-year Treasuries as from 10-year Treasuries, it tells us it’s concerned and cautious, worried about the economic outlook. Lenders are demanding nearly as much on their money for two-year loans as for 10-year loans. Rising bond yields mean the underlying bond prices have fallen considerably as investors have sold them. And they’re selling because they expect higher short-term rates. But most people own bonds, especially these two, because they consider them to be very safe. What most don’t realize is when we’re in a rising-rate environment, bonds fall. Essentially, investors have been leaving these bonds, likely for safe havens like cash, precious metals, and maybe even some value stocks that pay a reasonable dividend.

Unfortunately, many have recently learned this lesson the hard way. Bonds have been in a 40-year bull market, but that appears to be coming to an end.

In this environment of sustained high inflation, silver, gold, commodities and related investments tend to be the best place to be invested. That’s how it’s played out in the past. And I’m certainly betting that’s how it’s going to play out again.

So far in 2022, the S&P 500 is down 4.2%, while silver is up 8.7%. That’s a nearly 13% outperformance.

And given the challenges to the economic outlook, I expect that trend to continue for many more years.

This content is available through subscriber support. To see our subscription options, please click here. To subscribe to the Silver Stock Investor, please click the button below.