Optimal Silver Allocations

From the Silver Stock Investor newsletter | November 2022

This content is made possible through subscriber support. Not a subscriber yet? Click here to see our subscription options.

Subscribe today and GET 20% OFF if you add the SILVER20 promotional code at checkout.

Oxford Economics, together with the Silver Institute, recently published some very interesting research on silver. The report, called The Relevance of Silver in a Global Multi-Asset Portfolio, looked at how silver could contribute to optimal returns while minimizing risk.

As they state: “This study examines whether silver should be viewed as a distinct asset class that warrants a strategic investment allocation within an efficient multi-asset portfolio. We find that the optimal allocation to silver is significantly higher than holdings in most institutional investor portfolios.”

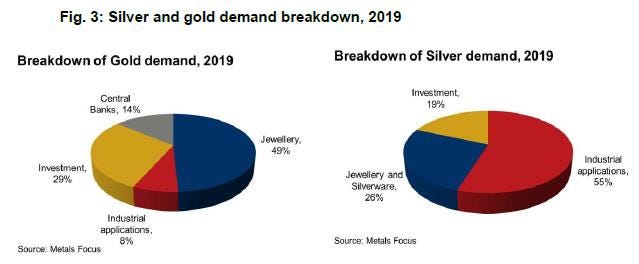

We know that silver is often compared with gold, but as I’ve highlighted many times, over half of silver demand is for industrial purposes, whereas less than 10% of gold finds its way into industry. As a result, silver prices depend on the industrial economic cycle, which naturally contributes to its volatility.

To determine whether including silver in a diversified portfolio is beneficial, the researchers compared how silver performed historically against a group of typical assets like stocks, bonds commodities, and gold between January 1999 and June 2022. More specifically, the other asset classes are gold, commodities (broad basket), equities (developed market large/mid cap, developed market small cap and emerging market) and bonds (developed market and emerging market). Thanks to silver’s low correlation with all of these except gold, it was determined that holding some silver makes sense.

Taking things a step further, researchers decided to run multiple simulations which varied the percentages of each asset class. The goal was to reach the highest risk-adjusted returns, while adjusting for three different levels of investor risk tolerances.

What they ultimately found looks like this.

For the period between January 1999 and June 2022, an optimal low-risk diversified portfolio would have held 4.4% silver, a medium-risk portfolio 4.9%, and a high-risk portfolio 4.7% over 5- year rolling periods. Ultimately, the conclusion is that silver is a safe-haven asset, albeit a more volatile one than gold and bonds (historically).

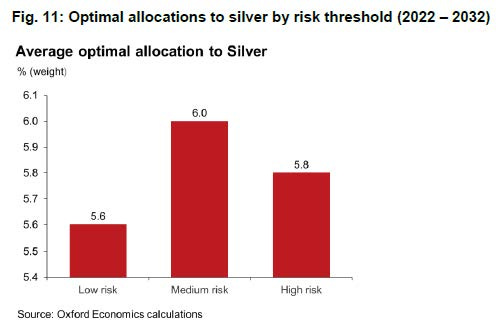

Then the researchers decided to look into the future because, of course, that’s what matters most to us. They decided to model portfolios with a silver allocation in low, medium and high- risk portfolios over the next ten years, with the same goal in mind of silver’s potential contribution in an optimized multi-asset portfolio.

Consideration was given to recent market behaviour, as well as government and central bank policy actions. Using the Oxford Global Economic Model, the researchers established baseline assumptions for asset returns over the next decade. One interesting factor is that they believe silver could be somewhat insulated from downside price risk versus gold, as it has not yet risen to the same extent in recent years. The currently high gold/silver ratio is indicative of this. As you can see in the left chart below the ratio is at 85; historically high versus its average of the past 40 years, which has been closer to 65. On this basis silver quite cheap relative to gold.

With all of these aspects factored in, the simulation results suggest a slightly higher silver allocation over the next ten years versus the past 22 years.

As you can see in the next chart, their research points to optimal silver allocations of 5.6% for a low-risk portfolio, 6% for a medium-risk portfolio, and 5.8% for a high-risk portfolio.

The bottom line from this highly valuable research effort is that it pays to own silver. Despite being highly correlated to gold, having significant industrial applications, and being relatively undervalued, silver’s differentiating qualities make it a valuable portfolio diversifier.

Oxford Economics and the Silver Institute point out that the average investment portfolio currently has only indirect exposure to silver of about 0.2% through a basket of commodities. And their conclusion is that investment managers would be wise to boost their allocations to silver for the benefits of lowering risk while increasing returns.

The way I see it, there’s a huge gap between the 6% recommended allocation for a medium risk going forward, and the 0.2% current indirect exposure to silver. In order to reach that optimal 6% level, the average portfolio would need to increase its silver exposure 30-fold!

Realistically, I’m not expecting that to happen. But even if they would up their exposure to 2%, that would mean a 10 times increase in silver holdings. Remember, silver is a small market, just 10% of the gold market based on the value of annual supply. Significant buying would be likely to have a notable impact on silver prices.

In any case, this report reinforces what we’ve already known for some time: silver is a crucial part of everyone’s portfolio. The right level of exposure becomes a matter of personal risk tolerance.

To see our subscription options, please click here.

To subscribe to the Silver Stock Investor, please click the button below.

Add promotional code RESOURCEMAVEN30 during checkout and get 30% OFF!