Incrementum fund management produces the outstanding annual In Gold We Trust Report. It’s an absolute wealth of must-read information for the precious metals investor, and really anyone who wants to keep tabs on the pulse of the global economy and the macro environment. If you wish to read the In Gold We Trust report, you can download it here.

Thankfully, again this year they’ve dedicated a section to silver: Silver’s Inflation Conundrum.

The first point they make is that silver prices are closely correlated with real rates. In my recent book, The Great Silver Bull, I make that same case and provide a chart showing that relationship. This is also true for gold: real rates are the single best indicator of what’s likely to happen next with precious metals, which tend to move inversely to real rates.

In August of 2020, real rates stagnated, but from that point until February 2021, silver outperformed gold. But that ended when Fedwire, “a real-time gross settlement system used by banks, businesses and government for – as the Federal Reserve itself puts it – “mission-critical same-day transactions”. IGWT concludes that the banking system began expecting higher odds of monetary deflation, which is a negative for silver. Indeed, the gold-silver ratio soon bottomed, began trending higher, and has held around 85 since early May. That’s historically high. And once we see the ratio begin to fall, and cross below 80, we’ll have a strong indicator that a new silver rally may be in the works.

As the IGWT report suggests, “Silver prices will rise in concert with persistent, pervasive monetary inflation”. I fully agree as that’s what we’re almost certainly going to see as central planners keep rates historically low, allowing inflation to run and making the repayment of debts less burdensome.

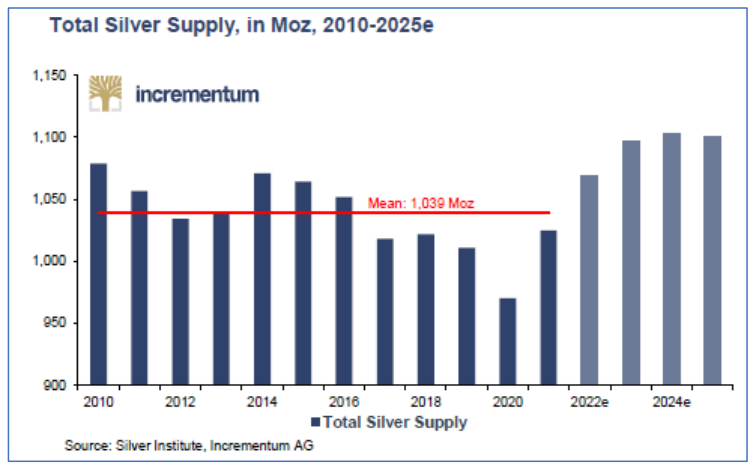

Looking at the supply and demand aspect of silver, IGWT’s chart suggests a supply peak is just a couple of years away.

We did see an overall supply increase by 5.6% last year, and analysts forecast another increase of 4.3% this year to 1,069Moz. But as the above chart demonstrates, the total annual silver supply has stayed basically unchanged over the past decade. The forecast high of 1,100Moz. is expected in 2024, followed by a small decline the following year.

The next chart shows mine supply, rather than total supply which includes recycling as a source. Interestingly, since 2016, these charts look very similar.

Mine supply is forecast to reach 900Moz. for the first time ever in 2023, but to peak in 2024 followed by a small decrease.

Mexico and Peru, the world’s #1 and #2 producers, account for nearly a third of global supply. Along with China in the third spot, these are the only three accounting for 10% or more of global output. Recycling is expected to drop by 5% this year. Meanwhile, speculative supply from ETFs, exchange inventories, bullion dealers and miner hedging is expected to be about 2Moz., an amount unlikely to have much if any effect.

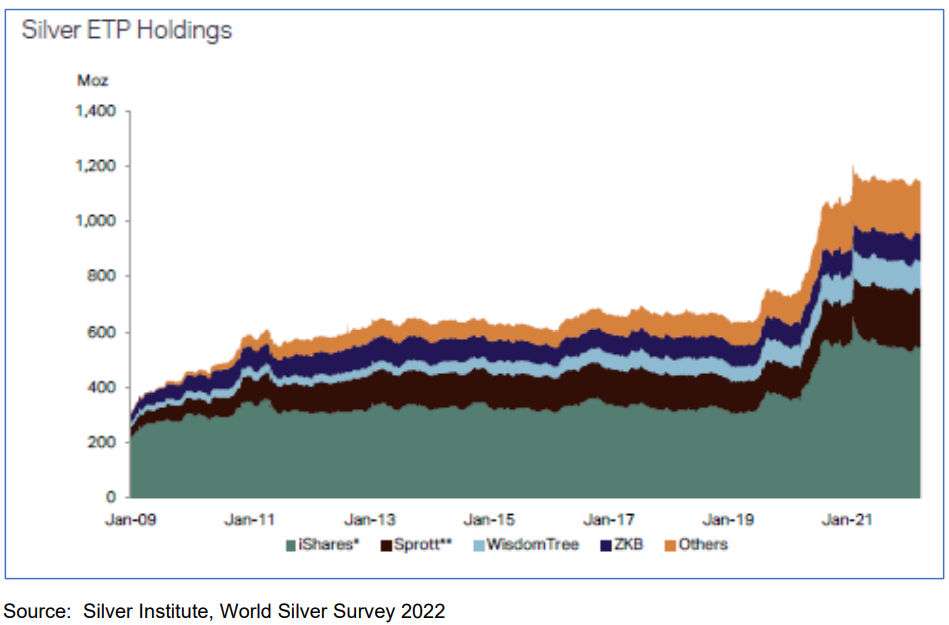

It also suggests that these participants are unlikely to sell their silver. This is a point I’ve highlighted many times in the past, especially regarding ETFs. The trend since the first silver ETF (NYSE:SLV) was introduced in 2006 has overwhelmingly been one of accumulation. This is a phenomenon I examine in more detail in my book, The Great Silver Bull. Even when silver prices drop significantly, outflows tend to be very limited. There’s a very clear bias towards accumulating holdings, which are now comfortably above 1.1 billion ounces: the equivalent of an entire year’s silver supply.

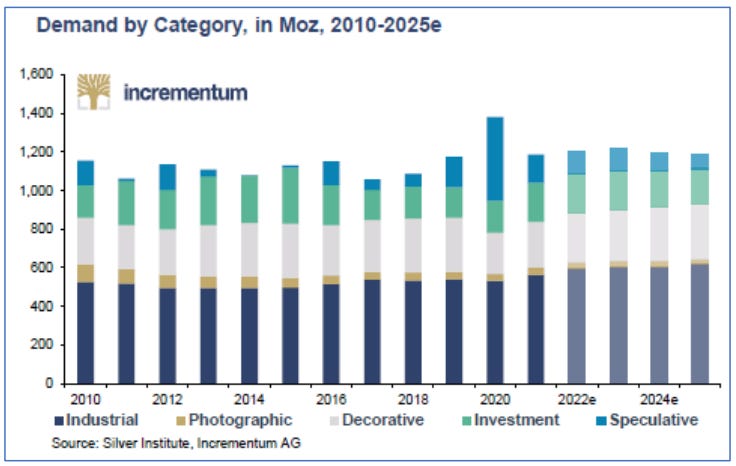

The authors of the IGWT report believe the consensus outlook for industrial demand is simply too optimistic. And given the ongoing central bank rate hikes, combined with growing recession fears and persistently high inflation, I tend to agree. The Silver Institute expects silverware demand to increase by 23% this year. But as the IGWT report authors point out, ornamental demand is likely to grow when consumers enjoy rising incomes and have a positive outlook on the economy. That’s not the case right now, especially with raging energy prices, food shortages, an ongoing war in Ukraine, and consumers citing inflation as their number one financial concern.

Financial is 18% of the overall demand for physical silver, made up of government and retail buying of coins and bars. The IGWT report points out consensus forecast is for a tiny increase of just 3% this year. Again they suggest the economic outlook is sufficiently bleak that buying of physical silver is likely to be much stronger, given widespread concerns about the economy, a possible recession, ongoing uncertainty and inflation risk.

And speculative demand, which includes ETFs, commodity exchange and dealer inventories, and miner hedging, represents 9% of world silver demand. The consensus is for a 21.5% drop in demand. The IGWT report suggests this is unlikely, once again given the rise in global uncertainty.

The report concludes that history suggests silver will follow gold through this decade at least. And they propose that geopolitical and socioeconomic upheaval will lead to sustained buying from individuals, institutions and governments. What’s more, they expect inflation will remain elevated through the 2020s and likely into the next decade, and help fuel much higher silver prices in the process.

Where I take a different tack is with industrial demand. While I agree that industrial consumption is not likely to be as strong as consensus, especially with a recession in the cards, I do think the ongoing government and institutional push for the green energy revolution will provide a surprisingly solid demand floor for silver prices. What’s more, the world is frantically trying to wean itself off Russian oil and natural gas. Solar is an emission-free alternative.

Let me explain a little further. Remember, solar alone accounts for 11% (114Moz.) of all silver demand, and solar installations are set to grow dramatically. I highlighted that right now solar accounts for just 3% of the global electricity supply. The International Energy Agency (IEA) forecasts solar capacity to be up an astounding 8.5 times the current level by 2030. If that happened, solar alone would consume nearly all of the current silver supply: 114Moz. x 8.5 = 969Moz. And yet the total annual supply of silver is expected to be 1,030Moz.

But it gets even more interesting…

My friend Chen Lin writes the excellent newsletter What is Chen Buying? What is Chen Selling? At the May Metals Investor Forum conference, Chen showed a chart that highlights silver usage from the solar panel industry, along with the next likely solar panel technologies.

This slide from his presentation has some parts translated. Remember, China essentially dominates both solar technology and solar panel manufacturing.

What’s most important to note is how silver usage increases by 50% when we jump to the next photovoltaic technology (TOPCON), and by 150% with the technology that follows from there (HJT). And yet, lab efficiency increases only slightly, despite much higher silver consumption.

This suggests that as solar panel technology evolves, silver consumption will go up for each panel, and not continue to decrease or even flatline, as suggested by the Silver Institute.

And a report by ICBC Bank suggests global solar installation growth will remain on track in the second half of this year, with full-year new installation growth of 24% over 2021. They cite supportive policies in China and the EU, and suspended tariffs from the US on Southeast-Asia nations. And recent research by Rystad Energy suggests the single most important requirement to achieve decarbonization is the deployment of new solar PV capacity.

With this in mind, along with reasonably steady demand from electronics, electrical, medical and investment sectors, I think overall silver demand will surprise to the upside this year. And while we could see several months of sideways action, I see very limited downside risk.

This content is available through subscriber support. To see our subscription options, please click here.

To subscribe to the Silver Stock Investor, please click the button below.

Add promotional code RESOURCEMAVEN30 during checkout and get 30% OFF!